The U.S. telecom market is more competitive than some stakeholders have argued, according to a new broadband competition report from the Information Technology and Innovation Foundation (ITIF). In particular, the researchers took aim at previous reports suggesting that the more lightly regulated U.S. is behind the more heavily regulated Europe when it comes to broadband.

The idea that the U.S. broadband market isn’t as competitive as that of Europe is based, in large part, on studies that have found slower broadband speeds and/or higher broadband prices in the U.S. For example, a 2021 Ookla report found that the U.S. ranked 15th in average broadband speed, behind several Asian and European countries.

According to the ITIF report, however, the differences in pricing and speeds are the result of differences in cost structure between providers in the U.S. and Europe. And European regulations such as network unbundling that are designed to spur competition actually decrease network investment, the authors argue.

Among the findings of the ITIF broadband competition report:

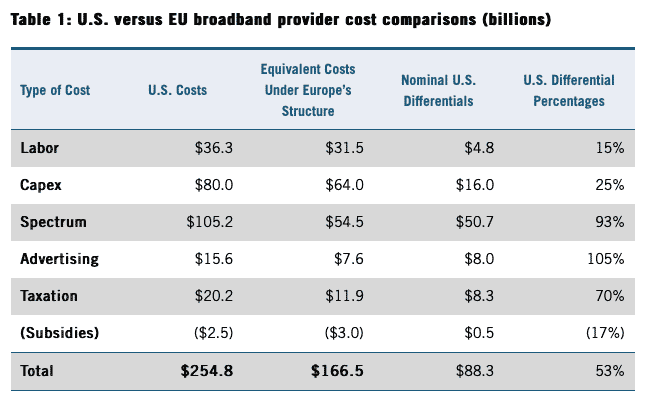

- Although telecom companies in both the U.S. and Europe have about two employees per 1,000 customers, the wages paid in the U.S. are about 13% higher.

- The U.S. is less urban than Europe, making broadband deployment more costly. Italy and Spain are twice as urban as the U.S. and the U.K. is three times more urban.

- U.S. providers invest about $700 per home per year, which is about three times higher in comparison with what European providers invest.

- U.S. providers have been more aggressive in deploying fiber broadband. In 2020, 55% of U.S. households subscribed to speeds of at least 100 Mbps, in comparison with 34% in Europe.

- The capital expenditure-to-sales ratio is 17.3% in the U.S., compared with 14% in Europe

- Over the last six years, U.S. providers spent an average of 22.8% of revenues on spectrum, compared with 11.8% spent on spectrum by European providers.

- U.S. providers spend twice as much on advertising as European providers spend.

- U.S. providers pay higher taxes in comparison with European providers.

- Subsidies paid to U.S. providers comprise .39% of total revenues, compared to a .47% share of sales in Europe.

- EBITDA as a percentage of sales was 24.1% for wireless and 31% for wireline in Europe, compared to 16.5% for wireless and 25.8% for wireline in the U.S.

The ITIF report was written by long-time telecom industry researcher Robert Atkinson and Jessica Dine.

It’s not clear what motivated ITIF to release this report at this time, but it may be related to comments we have heard from the Biden administration arguing for more competition in the U.S. telecom market.